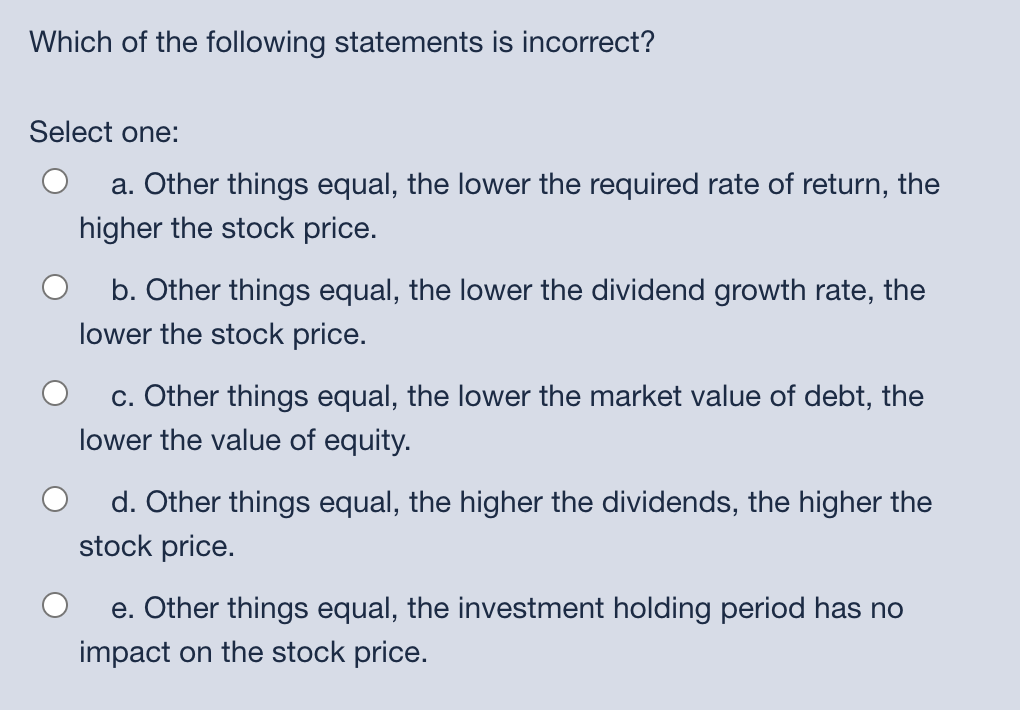

Answer choices seps have a higher tax deductible contribution limit than an ira. The taxpayer is not required to pay income tax on the transferred amounts in the year of conversion.

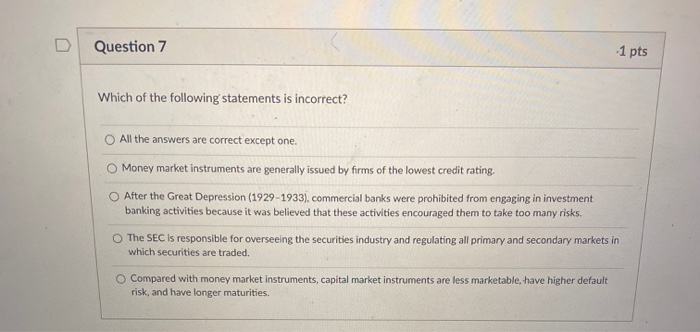

Which Of The Following Statements Is Incorrect Regarding Iras. Explain the requirements for the deduction of contributions to an individual retirement account. The taxpayer is not required to pay income tax on the transferred amounts in the year of conversion. Employer contributions are no tax deductible. Statements b and c are incorrect because the participant in a money purchase pension plan generally bears all of the investment risk and benefit of the plan assets.

Solved Question 1 1 Pts Which Of The Following Statements Is | Chegg.com From chegg.com

Solved Question 1 1 Pts Which Of The Following Statements Is | Chegg.com From chegg.com

Related Post Solved Question 1 1 Pts Which Of The Following Statements Is | Chegg.com :

The ability to make deductible contributions to a Statement d is incorrect because an employer with fluctuating cash flows would not choose a money purchase pension plan because of the mandatory funding requirement. Explain the requirements for the deduction of contributions to an individual retirement account. Javatpoint = java name1=name (abc) name2=name1.

The amount of money an individual can contribute to their ira is limited, indexed annually and set by law.

Upon conversion, the death benefit of the permanent policy will be reduced by 50%. Taxpayers who make both deductible and nondeductible ira contributions must maintain separate ira. Life insurance proceeds paid on the death of a key employee is a negative 45) which of the following statements is incorrect? Surrender charge is applied b. Which of the following statements regarding iras is false?

Source: chegg.com

Source: chegg.com

(a) the maximum annual contribution is $5,500 for people under age 50. According to the fair credit reporting act, all of the following statements are true except if an applicant is declined for an insurance policy, he or she. 45) which of the following statements is incorrect?

Source: iras.gov.sg

Source: iras.gov.sg

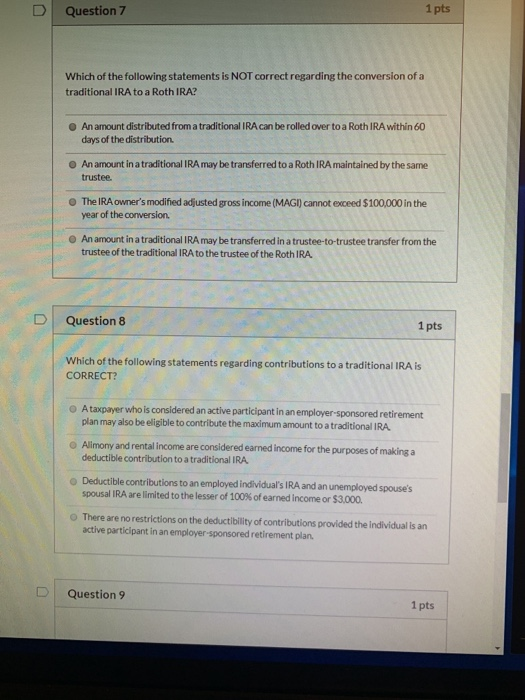

- which of the following statements is not correct with respect to roth iras? Which of the following statements concerning a simplified employee pension plan (sep) is incorrect? 12) which of the following statements is not correct with respect to roth iras?

Source: coursehero.com

Source: coursehero.com

The contribution to a traditional ira is a from agi deduction. Which of the following statements regarding iras is false? According to the fair credit reporting act, all of the following statements are true except if an applicant is declined for an insurance policy, he or she.

Source: coursehero.com

Source: coursehero.com

- which of the following statements is not correct with respect to roth iras? The account can be rolled into the surviving spouse�s ira c. The correct answer is b.

Source: chegg.com

Source: chegg.com

100% (1 of 1) what of the following statements is true regarding individual retirement accounts? All of the above incorrect. They must be approved by the irs 3.

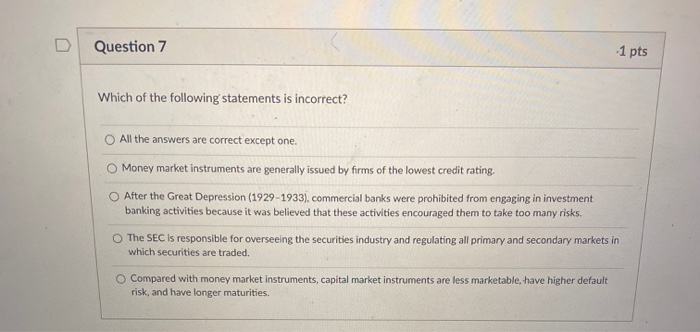

Which of the following statements concerning a simplified employee pension plan (sep) is incorrect? The taxpayer can receive a distribution from their traditional ira and personally contribute the money into their roth ira within 60 days of the distribution. Which of these is incorrect regarding a roth ira conversion?

Source: irs.gov

Source: irs.gov

There are no minimum distribution requirements for roth iras. All of the above incorrect. 100% (1 of 1) what of the following statements is true regarding individual retirement accounts?

Source: coursehero.com

Source: coursehero.com

Taxpayers who make both deductible and nondeductible ira contributions must maintain separate ira. Upon conversion, the premium for the permanent policy will be based upon attained age. Taxpayers can continue to contribute to roth iras after reaching the age of 72.

Source: coursehero.com

Source: coursehero.com

The taxpayer can receive a distribution from their traditional ira and personally contribute the money into their roth ira within 60 days of the distribution. Taxpayers can continue to contribute to roth iras after reaching the age of 72. Which of the following statements regarding roth iras is not correct?

Source: chegg.com

Source: chegg.com

The account can be rolled into the surviving spouse�s ira c. For 2020 calendar year personal tax return llers, the due date for lling the 1040 personal tax return is: 45) which of the following statements is incorrect?

Source: hrblock.com

Source: hrblock.com

Which of these is incorrect regarding a roth ira conversion? Explain the requirements for the deduction of contributions to an individual retirement account. The taxpayer can receive a distribution from their traditional ira and personally contribute the money into their roth ira within 60 days of the distribution.

Source: chegg.com

Source: chegg.com

D) statements based on common sense and judgment. Which of these is incorrect regarding a roth ira conversion? 12) which of the following statements is not correct with respect to roth iras?

Which of the following statements regarding traditional iras is false? They must be approved by the irs 3. Taxpayers can continue to contribute to roth iras after reaching the age of 72.

B) statements that standardize financial data in terms of trends. Explain the requirements for the deduction of contributions to an individual retirement account. 12) which of the following statements is not correct with respect to roth iras?

Source: coursehero.com

Source: coursehero.com

The taxpayer can receive a distribution from their traditional ira and personally contribute the money into their roth ira within 60 days of the distribution. Which of the following statements is correct regarding ira contributions for married taxpayers who file a joint tax return? A taxpayer may contribute to a traditional ira in 2018 but deduct the contribution on her 2017 tax return.

Source: amazon.com

Source: amazon.com

Employer contributions are not tax deductible B) statements that standardize financial data in terms of trends. It will throw the error as multiple references to the same object is not possible.

All of the following are true regarding the convertibility option under a term life insurance policy except 1. Javatpoint = java name1=name (abc) name2=name1. It will throw the error as multiple references to the same object is not possible.

Source: slideshare.net

Source: slideshare.net

A taxpayer may contribute to a traditional ira in 2018 but deduct the contribution on her 2017 tax return. 100% (1 of 1) what of the following statements is true regarding individual retirement accounts? C) statements that relate the firm to the industry in which it operates.

Upon conversion, the death benefit of the permanent policy will be reduced by 50%. Id (name1) and id (name2) will have same value. Which of the following statements is incorrect regarding iras?

Source: bjanaesthesia.org

Source: bjanaesthesia.org

Evidence of insurability is not required. A) net income and common stock. Dwhich of the following statements regarding iras is false?

Also Read :