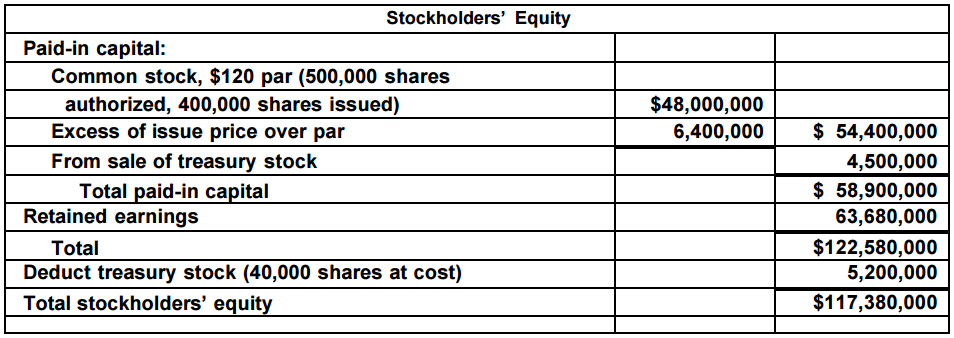

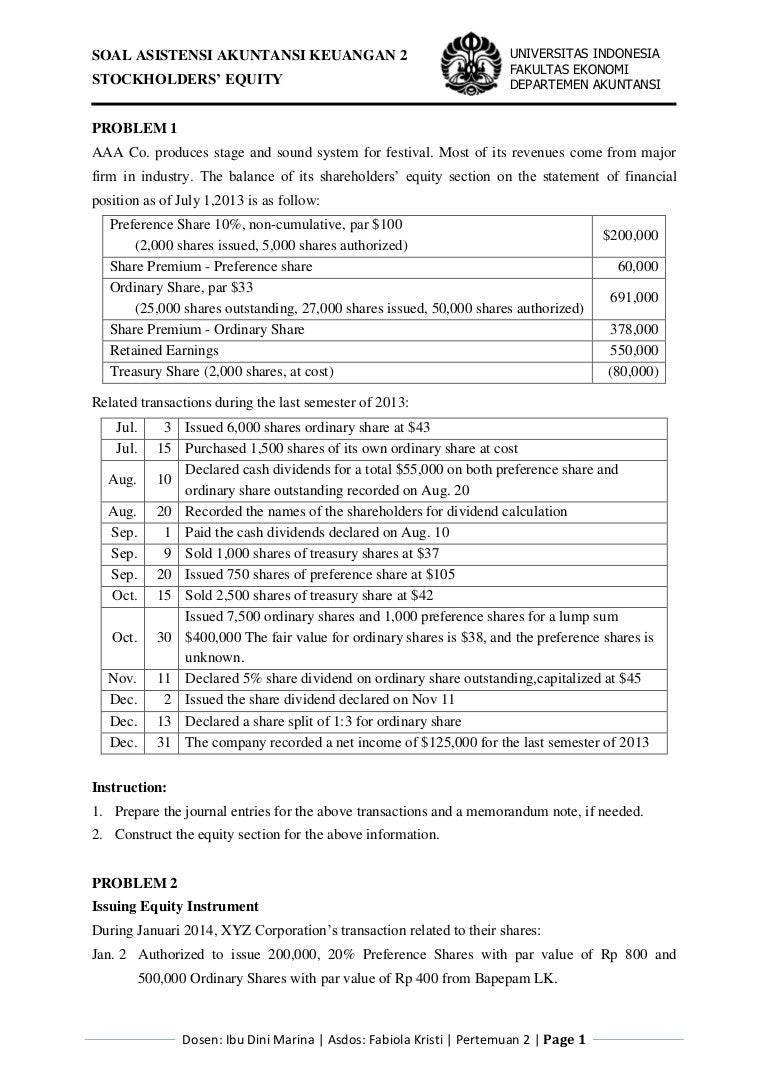

Franklin corporation has the following account balances at the end of the year. 11) which of the following accounts is a stockholders'

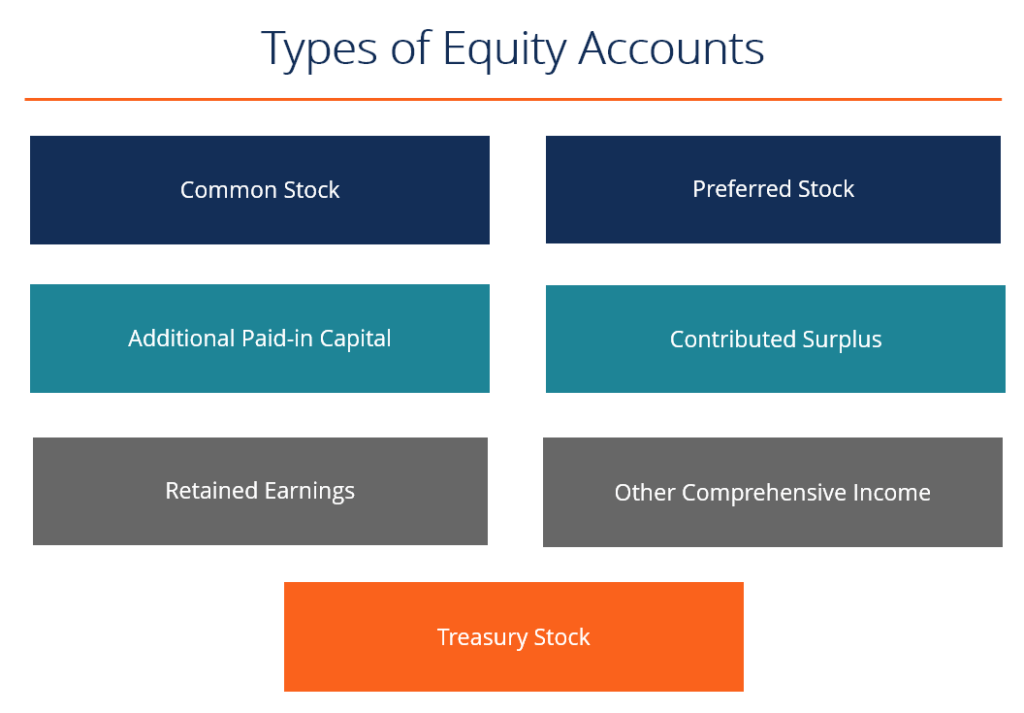

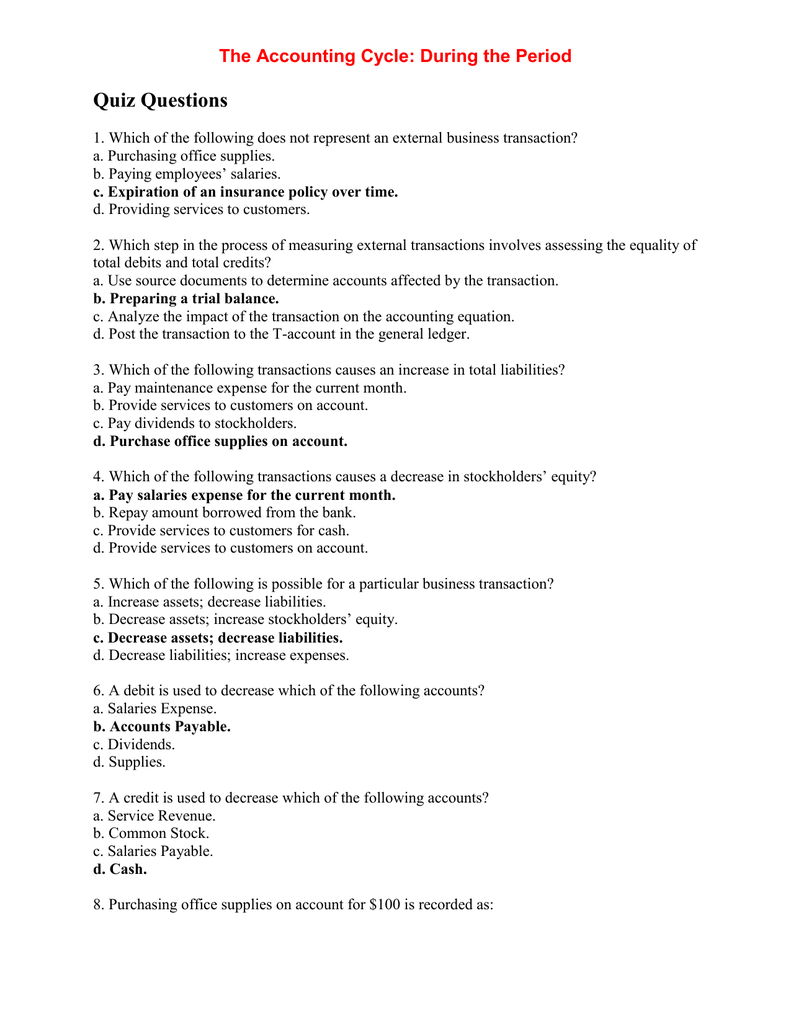

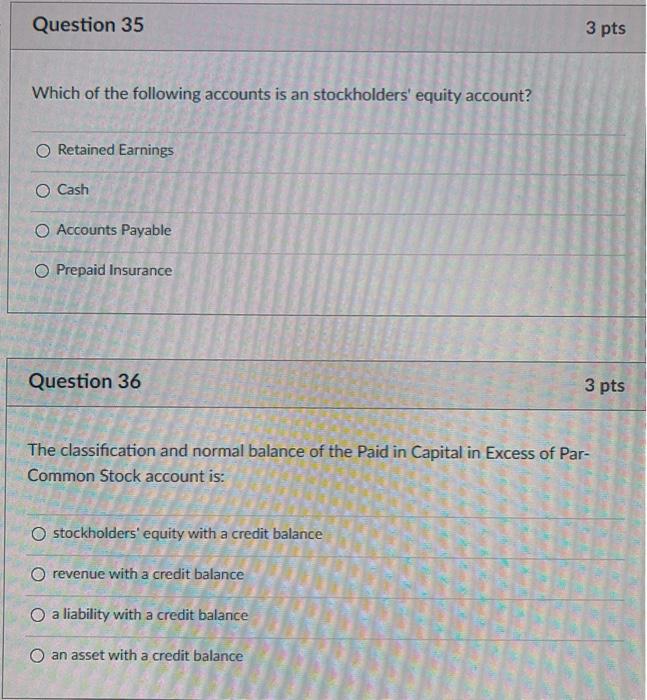

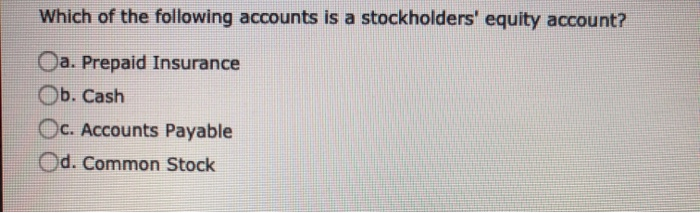

Which Of The Following Accounts Is A Stockholders Equity Account. An account is an individual accounting record of increases and decreases in specific assets, liability, and stockholders equity items. A) accrued liability b) accounts payable c) prepaid expense d) retained earnings 12) prepaid expenses are recorded as: Which of the following accounts is a stockholders� equity account? Which of the following is not a stockholders equity account previous practice:

Statement Of Stockholders� Equity - Principlesofaccounting.com From principlesofaccounting.com

Statement Of Stockholders� Equity - Principlesofaccounting.com From principlesofaccounting.com

Related Post Statement Of Stockholders� Equity - Principlesofaccounting.com :

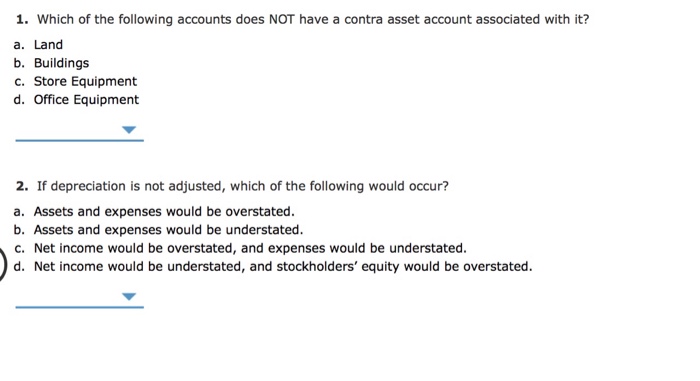

In the general ledger most of the stockholders� equity accounts will have credit balances. Accounts payable $17,000 accounts receivable $23,000 cash $35,000 equipment, net $41,000 notes payable $29,000 salaries payable $8,000 supplies $3,000. 13) in a typical chart of accounts, liabilities appear before assets. The stockholders� equity accounts of a corporation will appear in the chart of accounts, general ledger, and balance sheet immediately following the liability accounts.

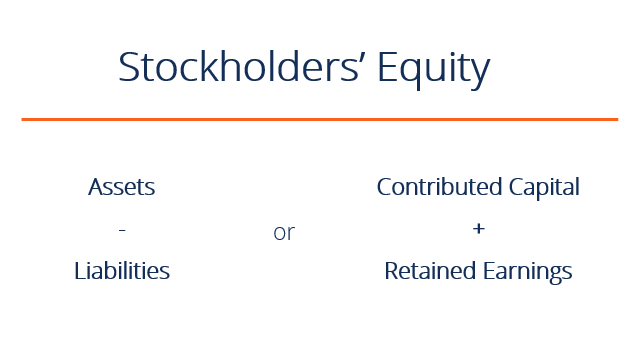

Assets increase and stockholders� equity increases.

The following account balances relate to the stockholders equity accounts of kerbs corp. Which of the following accounts is a stockholders� equity account? When a company provides services to a customer for cash, which of the following would be recorded? Cash, accounts payable, buildings b. The following are brief descriptions of typical stockholders� equity accounts. D) both a and c.

Source: principlesofaccounting.com

Source: principlesofaccounting.com

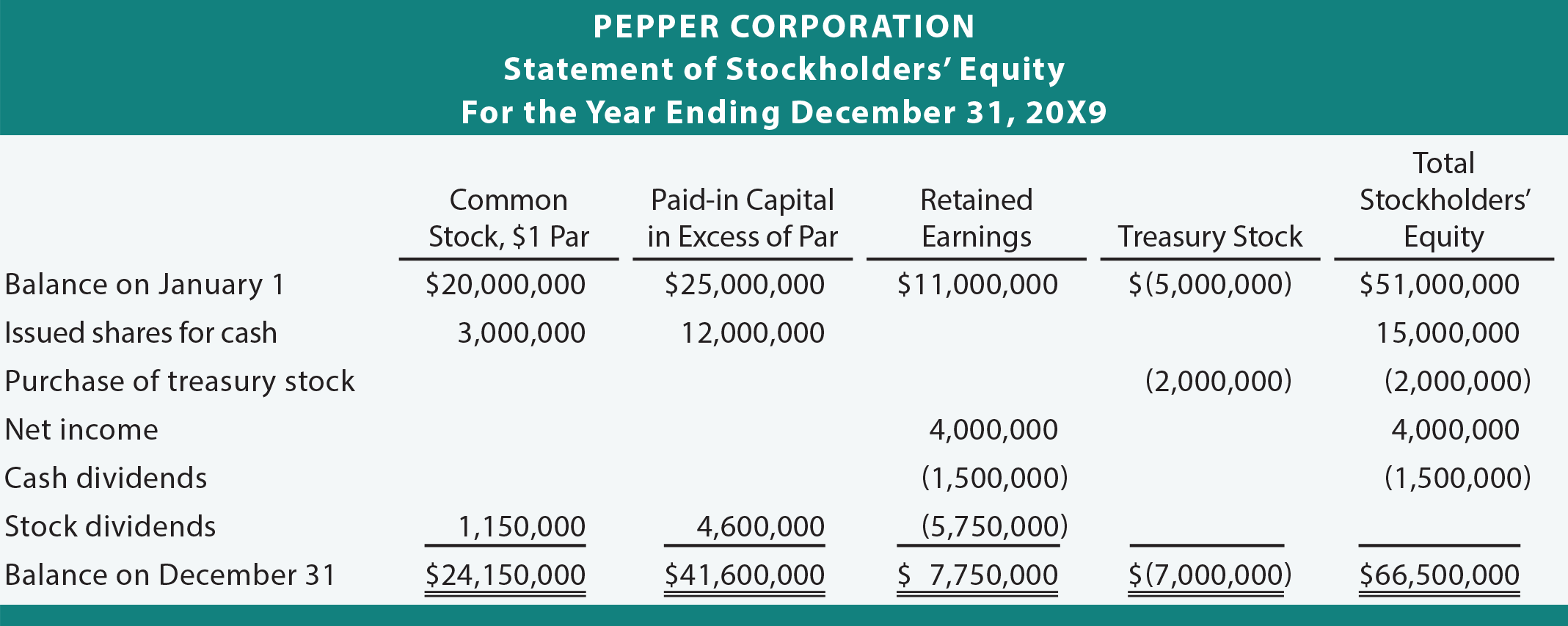

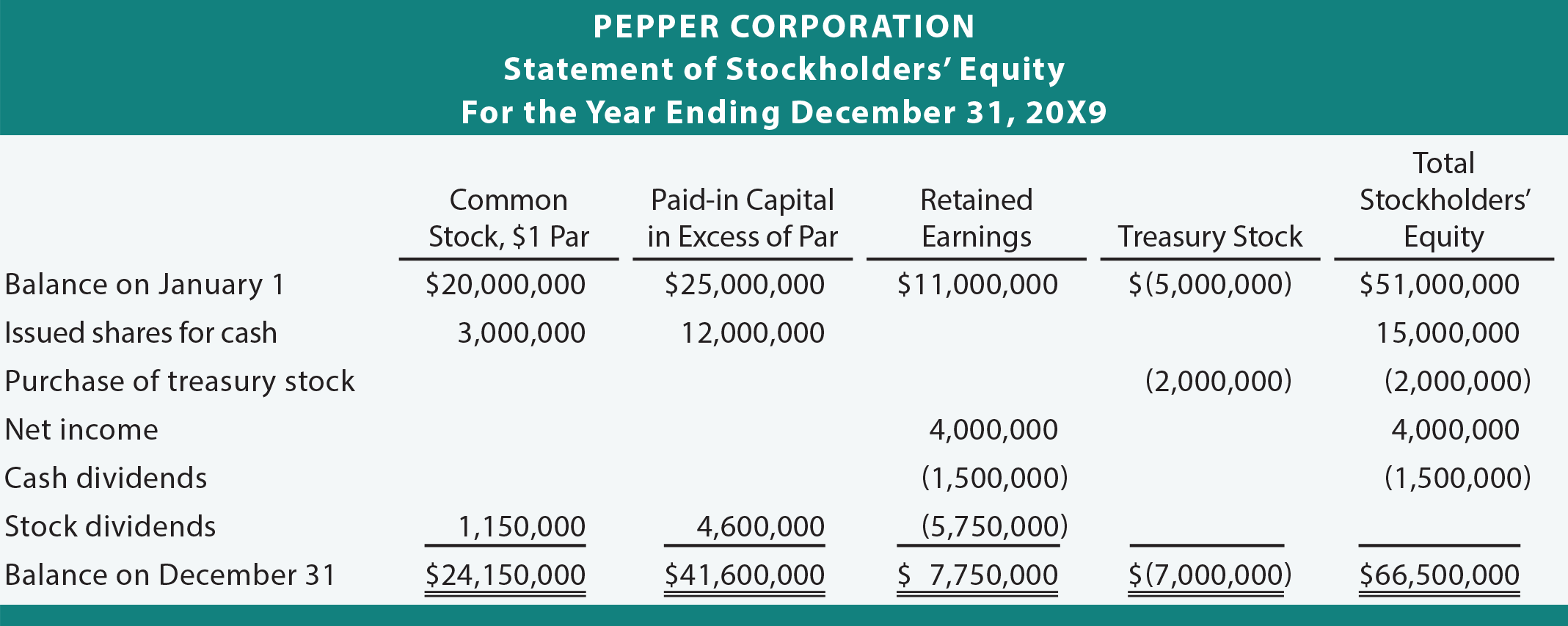

The statement of stockholders’ equity is a financial statement that summarizes all of the changes that occurred in the stockholders’ equity accounts during the accounting year. Liabilities increase and stockholders� equity increases. Unearned revenues, prepaid expenses, cash 8.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

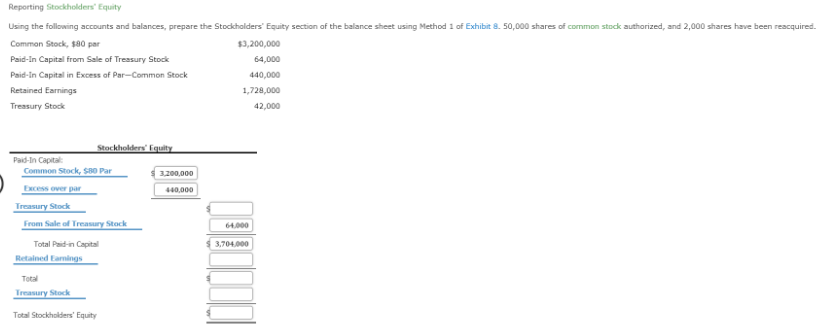

Cash dividends were $15,000 in both 2020 and 2019. Which of the following group of accounts are all assets? In this light you can view the stockholders� equity accounts (along with the liability accounts) as sources of the amounts reported in the asset accounts.

Source: accountingqa.blogspot.com

Source: accountingqa.blogspot.com

A.revenue, common stock, and retained earnings accounts b.dividends accounts only c.expense and dividends accounts d.expense accounts only Accumulated gains and losses on certain foreign currency transactions should be reported as a component of stockholders equity entitled other comprehensive income. The following are brief descriptions of typical stockholders� equity accounts.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

A) accrued liability b) accounts payable c) prepaid expense d) retained earnings 12) prepaid expenses are recorded as: The left side of an account is the credit, or decrease, side. The result of the stock dividend was to decrease retained earnings by $10,500 and increase common stock by $10,500.

Source: cnx.org

Source: cnx.org

Increase the total cash dividends paid to stockholders capitalize retained earnings decrease total stockholders equity decrease market value per share Answers (b), (c), and (d) are all temporary accounts. In this light you can view the stockholders� equity accounts (along with the liability accounts) as sources of the amounts reported in the asset accounts.

Source: accountingqa.blogspot.com

Source: accountingqa.blogspot.com

Partnership mcqsmcqs 1 to 10 (a) debited in trading account (b) credited in trading account (c) credited in profit and loss account (d) debited in profit and loss account (a) machinery to manufacture goods for resale (b) stock of goods Temporary accounts consist of the revenue, expense, and dividend accounts. Which of the following accounts is a stockholders� equity account?

Source: investopedia.com

Source: investopedia.com

The balance of retained earnings after closing agrees with the amount reported on the statement of stockholders� equity and the balance sheet. These accounts accumulate and summarize information for net income and dividends for that period. The statement of stockholders’ equity is a financial statement that summarizes all of the changes that occurred in the stockholders’ equity accounts during the accounting year.

Source: youtube.com

Source: youtube.com

There is no effect on the accounting equation as one asset account increases while another asset account decreases. Increase the total cash dividends paid to stockholders capitalize retained earnings decrease total stockholders equity decrease market value per share Answers (a), (b), and (d) are incorrect because these items are reported.

Source: studylib.net

Source: studylib.net

The result of the stock dividend was to decrease retained earnings by $10,500 and increase common stock by $10,500. 13) in a typical chart of accounts, liabilities appear before assets. It is one of the four financial statements that.

Assets increase and stockholders� equity increases. Accounts payable $17,000 accounts receivable $23,000 cash $35,000 equipment, net $41,000 notes payable $29,000 salaries payable $8,000 supplies $3,000. 11) which of the following accounts is a stockholders'

Source: transtutors.com

Source: transtutors.com

Temporary accounts consist of the revenue, expense, and dividend accounts. In the general ledger most of the stockholders� equity accounts will have credit balances. A small stock dividend was declared and issued in 2020.

Source: transtutors.com

Source: transtutors.com

These accounts accumulate and summarize information for net income and dividends for that period. It is also known as the statement of shareholders’ equity, the statement of equity or the statement of changes in equity. Assets increase and stockholders� equity increases.

Source: quizlet.com

Source: quizlet.com

A.revenue, common stock, and retained earnings accounts b.dividends accounts only c.expense and dividends accounts d.expense accounts only A) accrued liability b) accounts payable c) prepaid expense d) retained earnings 12) prepaid expenses are recorded as: 20202019 common stock, 10500 and 10,000 shares, respectively for 2020 and 2019.$170,000$140,000 preferred stock, 5,000.

Source: itprospt.com

Source: itprospt.com

It is also known as the statement of shareholders’ equity, the statement of equity or the statement of changes in equity. Which of the following accounts is a stockholders� equity account? Unearned revenues, prepaid expenses, cash 8.

Source: slideshare.net

Source: slideshare.net

Which of the following accounts is a stockholders� equity account? 20202019 common stock, 10500 and 10,000 shares, respectively for 2020 and 2019.$170,000$140,000 preferred stock, 5,000. The following are brief descriptions of typical stockholders� equity accounts.

![Solved] Reporting Stockholders� Equity Using The Following Accounts And Balances, Prepare The &Quot;Stockholders� Equity&Quot; Section Of The Balanc… | Course Hero](https://www.coursehero.com/qa/attachment/25126619/ “Solved] Reporting Stockholders� Equity Using The Following Accounts And Balances, Prepare The &Quot;Stockholders� Equity&Quot; Section Of The Balanc… | Course Hero”) Source: coursehero.com

Accounts receivable, revenue, cash prepaid expenses, buildings, patents d. The following are brief descriptions of typical stockholders� equity accounts. D) the effect on stockholders� equity depends on whether or not cash is paid.

Source: chegg.com

Source: chegg.com

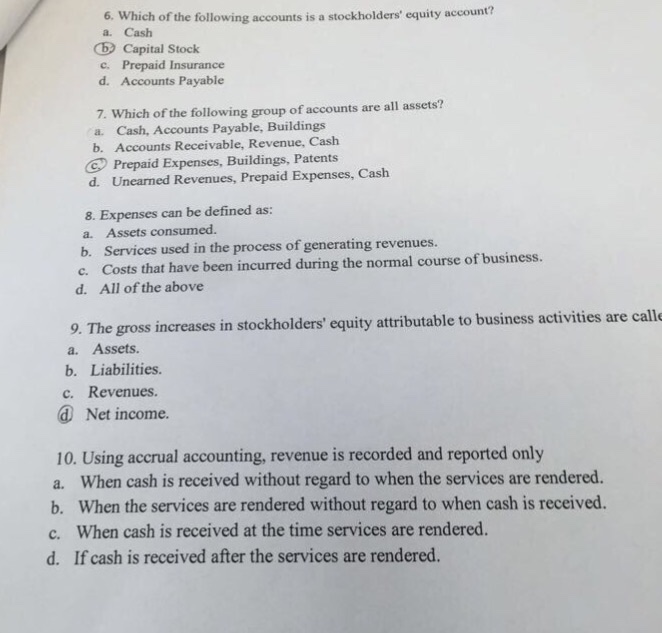

View chapter 2 quiz.pdf from english 00 at van nuys senior high. The following are brief descriptions of typical stockholders� equity accounts. Which of the following stockholders� equity accounts follows the same debit and credit rules as liabilities?

There is no effect on the accounting equation as one asset account increases while another asset account decreases. Franklin corporation has the following account balances at the end of the year. Which of the following accounts is a stockholders� equity account?

Source: bartleby.com

Source: bartleby.com

Liabilities increase and stockholders� equity increases. It is also known as the statement of shareholders’ equity, the statement of equity or the statement of changes in equity. Partnership mcqsmcqs 1 to 10 (a) debited in trading account (b) credited in trading account (c) credited in profit and loss account (d) debited in profit and loss account (a) machinery to manufacture goods for resale (b) stock of goods

D) both a and c. An account is an individual accounting record of increases and decreases in specific assets, liability, and stockholders equity items. In this light you can view the stockholders� equity accounts (along with the liability accounts) as sources of the amounts reported in the asset accounts.

Also Read :